Modeling Price Sensitivity and Future Cost of Private Scale Solar Energy Installations due to Projected Prices of Critical Materials

ABSTRACT

Developing renewable technologies is vital to create a sustainable society that does not depend on dwindling non-renewable energy resources. However, rising costs of crucial raw materials could severely hamper the development of such technologies, since they can only be implemented globally if they are more financially viable than non-renewable energy sources. We explore the impact of rising costs of rare metals on the price of solar panels through a price sensitivity study on a representative private-scale solar array. Our results show that the price of a 5 kW private solar array is highly sensitive to the prices of silver and silicon, and that private-scale solar arrays could increase in cost by up to 30 percent if raw material prices increase according to historic trends. This cost increase could severely impact the implementation of solar panels worldwide.

INTRODUCTION.

In an endeavor to fight climate change, the world is attempting to reduce greenhouse gas emissions. A crucial aspect of this process is transitioning away from fossil fuels as a primary electricity source. Currently, there is a 2095 GW capacity of coal-fired power plants supplying electricity to consumers [1], and this is expected to increase to 2319 GW in 2025 [2]. However, renewable electricity sources like solar and wind energy have been successfully demonstrated, with 1624 GW of solar capacity and 1017 GW of wind capacity globally as of 2023 [3,4]. However, some necessary materials for creating renewable energy sources, such as copper, take multiple decades to obtain after they are discovered due to regulations and permitting processes [5]. Rising costs caused by increasing demand and material shortages can hamper the development of these crucial technologies. For instance, the cost of essential materials like copper have surged, increasing from $2.86 per pound to $4.12 per pound in the past ten years [6]. The demand for copper could reach 50 million metric tons in 2035 [7], but the International Energy Agency (IEA) projects future supply to meet only 70% of anticipated demand in 2035 [8]. The rising cost of raw materials could lead to a rise in the cost of renewable power generation technologies and could therefore make renewable power generation less financially viable. By examining the impact of rising costs on solar panels, this work aims to quantify how much the price of solar energy could increase due to changes in cost of rare metals such as copper, silver, graphite, silicon, and lithium.

MATERIALS AND METHODS.

To quantify the rising cost of solar energy due to raw materials costs, we conducted a case study investigating how the cost of solar panels is affected by price changes in raw materials. For our case study, we analyzed five rare earth materials: silicon (present in wafers in the solar cell), silver (used as conductive paste), graphite (used as an anode in the battery), copper (present in wiring), and lithium (present in electrolyte and cathode of the battery). We compared two types of solar cells: monocrystalline solar cells and PERC cells. Monocrystalline cells are solar cells made from a single, continuous crystal structure, made of silicon, and are known for their efficiency and longevity. PERC (Passivated Emitter and Rear Cell) cells are solar cells that are similar to conventional monocrystalline cells but contain an additional passivation layer on the rear side, which enhances energy absorption and reduces energy loss, leading to higher efficiency. However, PERC cells are generally more expensive due to the addition of the passivation layer. Both types of solar cells are widely used, but PERC cells were chosen for this cost analysis due to their high efficiency and increasing usage in solar panels. We based our study on a private 5 kW solar array, a common array size for residential, private applications. We modeled the price of the entire 5 kW solar array as the sum of the prices of its requisite subsystems. These included solar cells, wiring, and the battery. Each subsystem price was modeled as the sum of the price of its requisite components and raw materials. The price of individual components within a subsystem was found via market research. The price of an individual component was obtained by a simple average of the price quoted from three or more suppliers. When modeling the price of the raw materials in individual subsystem components, we assumed that the primary cost of the subcomponent is the cost of the material. For example, we assumed the primary cost of a silicon wafer for the solar cell was the cost of raw silicon. As such we calculated the percentage change in the cost of a subcomponent primarily composed of a raw material as the projected percentage change in the price of the raw material, as shown in Equation 1.

\[{C^\prime}_c=\ {C^0}_c\ast\ \frac{{c^\prime}_r-\ {c^0}_r}{\mathrm{\Delta T}}\tag{1}\]

Where is the new subcomponent cost, is the original subcomponent cost, and are the new and old raw material costs respectively, and is the time in between the two raw material price points.

To model various price scenarios, we analyzed historic trends in material prices and used them to project the future cost of that raw material in 2035, assuming the price increases at the same rate as the average rate of change obtained from price data over the last 5 to 10 years [9]. This projection method is shown in Equation 2.

\[P_{2035}=\ P_{2024}\ast\ N_{years}\ \ast\ \frac{p_{2024}-p_h\ }{\mathrm{\Delta T}}\tag{2}\]

Where is the projected raw material price for 2035, is the original raw material cost, is the number of years in the given time period, and are the new and old raw material costs respectively, and is the time in between the two raw material price points.

To model the sensitivity of the model to our price projection, and to predict a range of future solar technology costs, we explored scenarios where prices increased 20% more than projected, 10% more than projected, 10% less than projected, and 20% less than we projected.

RESULTS.

Through the market research conducted in this study, we found that the total cost of a representative 5 kW solar array due only to raw material and individual component costs (not including installation, maintenance, or other administrative costs) was $7128.37. This cost is 26.96% less than the price of a similarly sized solar array on the market [10,11], demonstrating our model’s validity.

With the price model for a 5 kW solar array, we found the price increase of the total system if the price of silver, silicon, copper, graphite, and lithium increased according to historical trends. Additionally, we predicted the total price of the solar array if each of the raw materials increased to the projected 2035 price individually. The percentage difference to the current price point of a 5 kW solar array under each of these pricing scenarios is shown in Figure 1.

We can see that if the price of all raw materials increases per historical trends, the total system is 30% more expensive. Price changes in Silver and Silicon cause the greatest price increase, causing a 9.90% and 17.9% increase respectively, followed by lithium which causes a 2.00% increase in price. The case study’s solar array is not very price-sensitive to graphite or copper. The increasing price of graphite only causes a 0.41% increase in the price of the system, and the increase in the price of copper only causes a 0.18% increase in the price of the system. This illustrates that the price of solar panels is most sensitive to silicon and silver.

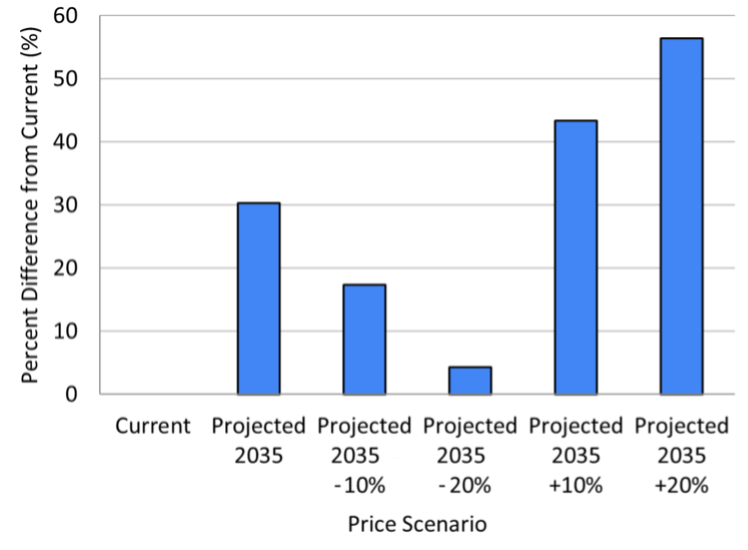

We also modeled various price scenarios, where prices of the raw materials changed by 20% more than expected, 10% more than expected, 10% less than expected, and 20% less than expected. The total system cost under these 2035 projection scenarios is shown in Figure 2.

We found that in the -20% scenario, the price of the total system only increases by 4.3%. However, in the +20% scenario, the price of the total system increases by 56%. Assuming a price of electricity of $0.31 per kWh (a representative price for a large city such as New York City), a 5 kW solar array in the +20% scenario will take 7194 hours of operation at full capacity to pay itself off, compared to the 4599 hours it would take with today’s raw material prices.

DISCUSSION.

Our results showcase that the price of solar energy could increase dramatically, possibly making solar energy less financially viable than non-renewable energy. This could lead to fewer people using renewable energy, which will have adverse effects on the environment. This case study demonstrates the need to find more silicon and silver to meet demand, find low-cost alternatives to them, or adjust technology to use less of these materials to avoid a large increase in the price of solar panels.

In future work we hope to further develop our price model by refining our assumption that the price of materials will increase at a constant rate. This may not be sufficiently reliable, since the prices may not increase linearly, and it also does not account for changes in supply or demand for each material. Additionally, the assumption that the raw material component is proportional to the price of the raw material may not hold true if the manufacturing is a very large portion of the cost of that subcomponent. Likewise, the accuracy of our predictions is affected by technological advances in manufacturing processes.

CONCLUSION.

In this work, we presented a price model of a representative-size solar array for private use. This price model was based on market analysis and historic prices for five critical materials. We demonstrated that the price of an array of this size is most sensitive to the price of silver and silicon. In addition, we showed that the overall price of a solar array of this size could increase by up to 56% in a +20% price scenario. This exemplifies the importance of further development of solar cell efficiency so that the electricity price of solar energy continues to decrease as raw material prices increase. If the price of solar energy rises, it will not be financially viable for private use, increasing private sector emissions. In future work we will utilize our methodology to examine the projected prices of other size solar arrays as well as other types of renewable energy such as wind or hydropower. Additionally, we look to refine our assessment of the projected price of raw materials by using predicted global supply and demand of each material to create a more comprehensive price model.

ACKNOWLEDGMENTS.

We would like to express our gratitude to Naveen Kadiyala and Madhavi Marupudi (parents of Pranav Kadiyala) for their encouragement through the process of writing this paper.

SUPPORTING INFORMATION.

Supporting information includes spreadsheet containing bill of materials and data used for obtaining results; spreadsheet containing market research and sources; spreadsheet containing cost breakdown for subcomponents

REFERENCES

- R. Cui, C. Wejnert-depue, C. Dahl, M. Westphal, N. Hultman, “State Of Global Coal Power 2023” (Centre for Global Sustainability, School of Public Policy, Univeristy of Maryland, 2023); Accessed June 20, 2024. https://cgs. umd.edu/research-impact/publications/state-global-coal-power-2023

- “Installed coal power generation capacity worldwide from 2005 to 2022, with a forecast until 2050.” (Statista, 2024); Accessed September 12, 2024. https://www.statista.com/statistics/217256/global-installed-coal-power-generation-capacity/

- “Cumulative installed solar PV capacity worldwide from 2000 to 2023.” (L. Fernández, 2024); Accessed September 12, 2024. https://www.statista.com/statistics/280220/global-cumulative-installed-solar-pv-capacity/

- “Our World In Data, Installed wind energy capacity.”(Our World in Data, 2024); Accessed October 9, 2024. https://ourworldindata.org/grapher/cumulative-installed-wind-energy-capacity-gigawatts#research-and-writing

- L. Cathles, A. Simon, “Copper Mining and Vehicle Electrification” (International Energy Forum, 2024); https://www.ief.org/focus/ief-reports/copper-mining-and-vehicle-electrification

- “Copper.” (Tradingeconomics.com 2025); Accessed October 9, 2024. https://tradingeconomics.com/commodity/copper

- “How copper shortages threaten the energy transition” (International Energy forum, 2025); https://www.ief.org/news/how-copper-shortages-threaten-the-energy-transition

- “Global Critical Minerals Outlook 2024” (IEA, 2024); Accessed October 9, 2024. https://www.iea.org/reports/global-critical-minerals-outlook-2024

- “Metals” (Statista 2024); Accessed October 9 2024. https://www.statista.com/markets/407/topic/434/metals/

- “5kW solar kit Axitec 550 XXL bi-facial, Sol-Ark hybrid inverter.” (SunWatts 2024); Accessed November 10, 2024. https://sunwatts.com/5kw-solar-kit-axitec-550-xxl-bi-facial-sol-ark-hybrid-inverter/

- “5.1kW solar kit Trina 425 black bi-facial, SMA hybrid inverter. (SunWatts 2024); Accessed November 10, 2024. https://sunwatts.com/5-1kw-solar-kit-trina-425-black-bi-facial-sma-hybrid-inverter/

Posted by buchanle on Friday, June 20, 2025 in May 2025.

Tags: Price Projection, Rare Materials, renewable energy, Solar Energy